Automated day trading systems cannot make guesses, so remove all discretion. Behind any automated trading system is an algorithm that identifies profitable trading opportunities.

FULLY AUTOMATIC TRADING /ROBOT/ALGO TRADING +6399803515

FULLY AUTOMATIC TRADING /ROBOT/ALGO TRADING +6399803515

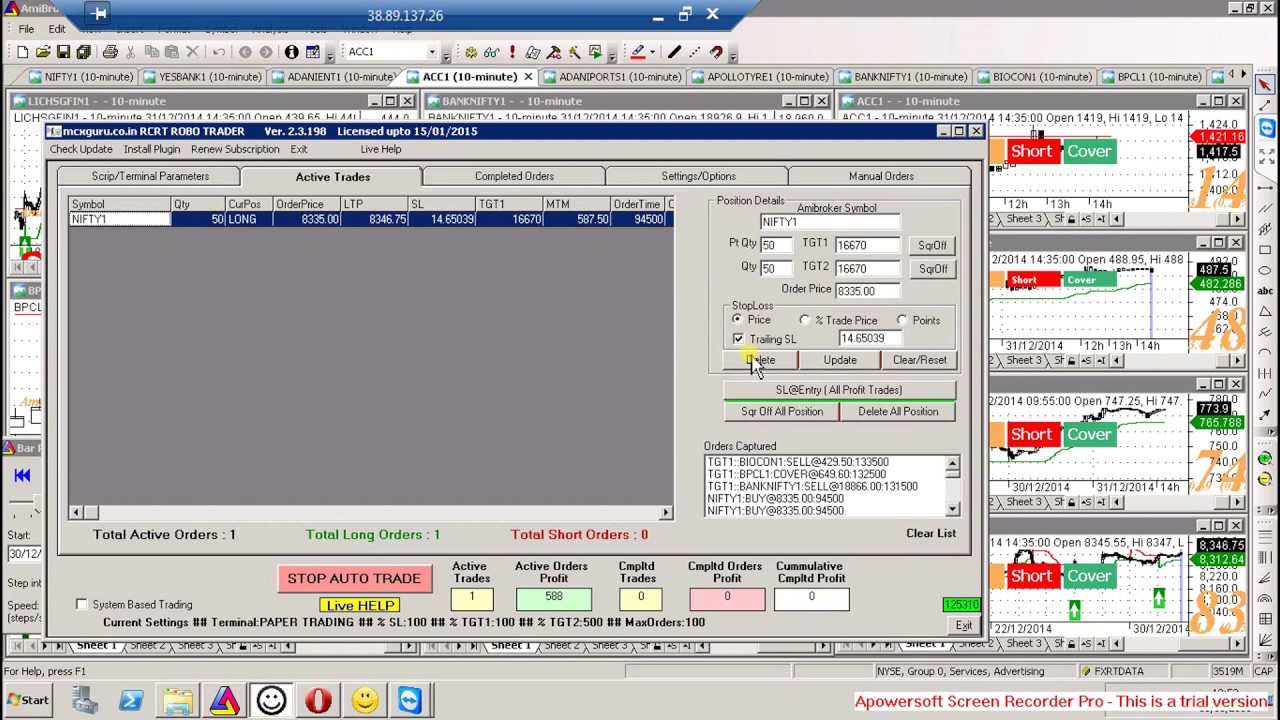

Once the system is programmed, the desired market is monitored and trades are made automatically.

Automated trading. Remote trading meniadakan peran seorang floor trader, karena dealer dapat langsung memasukan order dari kantor broker. The trading strategies are programmed to react to price movements and place orders to enter and exit as needed. It is done by using a software written according to a predefined strategy and it is a major solution for replacing the merchant's job.

When using algorithmic trading strategies, buying and selling of financial instruments is executed automatically and can be backtested on historical market data. As the trader, you’ll combine thorough technical analysis with setting parameters for your positions, such as orders to open, trailing stops and guaranteed stops. The sr countertrend ii is a proprietary day trading system that was developed in october 2017, designed to trade wide ranging counter trend price movements.

During each of the competitions, hundreds of expert advisors traded automatically according to their own dynamics for. Automated means it runs automatically, without the need for you to be glued to the computer so as to not miss any trade setups or exit points. With copy trading, you can copy the trades of another trader.

Whether you are doing high frequency trading, day trading, swing trading, or even long term trading, you can use r to quickly build a trading robot that trades the stocks or other financial instruments on your behalf. Some of the advantages in building a trading robot are. What's this chart about ?

So by reviewing past performance and specific trade details, you can ‘follow’ a trader, (or better, a. Now let’s fit the model with the training data and get the forecast. Automated trading software goes by a few different names, such as expert advisors (eas), robotic trading, program trading, automated trading or black box trading.

As the trader, you’ll combine thorough technical analysis with setting parameters for your positions, such as orders to open, trailing stops and guaranteed stops. To navigate to the automated trading window, you need to first have an order that you’re building inside of thinkorswim. Automated trading (also known as copy trading, bot trading, black box trading, robotic trading, or algorithmic trading) is the most advanced field among forex traders.

It is a low frequency, fully automated trading system that is designed to trade a list of commodity and futures markets. At a the most basic level, copy trading is a very simple form of automated trading. Automated software is a program that runs on a computer and trades for the person running the program.

A stock market trader using an automated platform can set. Automated trading systems minimize emotions throughout the trading process. The theoretical buy and sell prices are derived from, among other things, the current market price of the security underlying the option.

Once you have an order in the “trade” tab, you can then click the settings gear icon, to open up the automated trading panel: Automated trading software is a sophisticated trading platform that uses computer algorithms to monitor markets for certain conditions. An automated strategy adopted by experienced traders requires a programming language to create and develop trading robots.

The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. By keeping emotions in check, traders typically have an easier time sticking to the plan. The industry’s top automated trading system.

It can be visualized as a “robot” which is trading on your behalf. Automated trading software allows traders to set criteria which determine both entry and exit points in the financial markets, as well as making rules for money management. It can also trade equity indexes such as the spyder etfs.

Every year, the big prize money of $80,000 attracted hundreds of developers and thousands of traders. What is the automated trading triggers window? An automated trading system is no exception.

How To Choose An Automated Trading Strategy For Forex Trading

How To Choose An Automated Trading Strategy For Forex Trading

Automated Trading Systems Set It and It

Automated Trading Systems Set It and It

Factors Behind The Evolution Of Automated Trading In

Factors Behind The Evolution Of Automated Trading In

automated trading BluSignals Systems

automated trading BluSignals Systems

5 Benefits Of Using Automated Trading Platforms

5 Benefits Of Using Automated Trading Platforms

How Does Automated Trading Forex Work? foxservfoxserv

Automated Trading using Python

Automated Trading using Python

Best Automated Forex Trading Software For Traders

Best Automated Forex Trading Software For Traders

Automated forex trading software for beginners YouTube

Automated forex trading software for beginners YouTube

Red Flags to Look for with Automated Stock Trading

Red Flags to Look for with Automated Stock Trading

Few Things You Need to Know About Option Robot Automated

Few Things You Need to Know About Option Robot Automated

Automated Trading System Development with MATLAB YouTube

Automated Trading System Development with MATLAB YouTube

Benefits of An Automated Forex Trading System

Benefits of An Automated Forex Trading System

5 Benefits of Automated Trading Rd 4 Global

5 Benefits of Automated Trading Rd 4 Global

Automated Trading good or bad for your money?

Automated Trading good or bad for your money?

What Is Automated Trading? & Why You Should Consider It

What Is Automated Trading? & Why You Should Consider It

Automated Trading, Ninjatrader Strategy YouTube

Automated Trading, Ninjatrader Strategy YouTube

Automated Trading at Interactive Brokers with Tradestation

Automated Trading at Interactive Brokers with Tradestation

0 Comments:

Post a Comment